About NPS

NPS was introduced by the Central Government to help the individuals have income in the form of pension to take care of their retirement needs.

The Pension Fund Regulatory and Development Authority (PFRDA) regulates and administers NPS under the PFRDA Act, 2013.

NPS is a market-linked defined contribution scheme that helps you save for your retirement. The scheme is simple, voluntary, portable and flexible. It is one of the most efficient ways of boosting your retirement income and saving tax. It allows you to plan for a financially secure retirement with systematic savings in a planned way.

NPS is available to all the citizens of India and offers different models depending on the following user segments:

- All Central Government employees joining on or after January 1, 2004, are covered under the NPS scheme, except for those in the armed forces and is also extended to the employees of Central Autonomous Bodies from the said date. It is also available to all State Government employees/employees of State Autonomous Bodies, if the respective State/UT opted for it.

- NPS can be voluntarily adopted by the corporates for their employees and contributions are made to the NPS account as per the terms of employment.

- NPS voluntary model is available to all the citizens of India including those residing abroad, between the age of 18 and 70 years.

Online Services

Benefits of NPS

You get the freedom to decide your investment allocation among the four asset classes available, depending on your risk appetite and the return expectations. You also get the flexibility to shift your pension fund manager and scheme preference.

Opening an NPS account provides you with a "Permanent Retirement Account Number (PRAN)", which is a unique 12 digit number that remains with you throughout your lifetime. NPS also offers Tax benefits under the Income Tax Act 1961.

You get seamless portability across jobs, sectors and locations with NPS. It is a hassle-free process while shifting to the new job/location, without leaving behind the built corpus. After exercising the portability option, you can continue with the same scheme and fund manager or can also change as per your choice.

NPS is regulated by PFRDA with transparent investment norms, regular monitoring and performance review of pension fund managers by NPS Trust.

You get the benefit of lowest account maintenance costs with NPS as compared to similar pension products across the globe. While saving for a long-term goal such as retirement, the cost matters a lot as the charges can trim off a significant amount from the corpus over 35-40 years of investment period.

Till the time you stay invested, the accumulated corpus grows over a period of time at a compounding rate and offers optimum market linked returns based on your investment choice. With this dual benefit of low cost and compounding, you get the benefit of larger corpus.

You can open your NPS account online either through the eNPS portal. The facility of online contributions, activating Tier-II, D-Remit is also available online. You can manage/ access your NPS account online through the portals offered by the respective CRA.

Features of NPS

Types of Accounts

NPS scheme is structured into two tiers

Tier-I account :

This is the permanent retirement account into which the regular contributions made by the subscriber and/or their employer and are credited and invested as per the scheme/fund manager chosen by you.

Tier-II account :

This is a voluntary / optional withdrawable account which is allowed only you have an an active Tier I account. The withdrawals are permitted from this account as and when you require.

| Tier – I Account | Tier – II Account |

| Individual Pension Account | Optional Account and requires an active Tier-I Account |

| Withdrawal as per Exit & Withdrawal rules and regulations | Unrestricted withdrawals |

| Minimum contribution to open is ₹500/- | Min. Contribution to open is ₹250/- |

| Min. Contribution per year is ₹1000/- | There’s no restriction on min. Contribution per year |

| AMC charges applicable | No separate AMC charges applicable |

| - | Anytime switching to Tier-I allowed |

Asset Classes

You need to choose the asset classes as well Pension Fund Manager (PFM) along with the percentage allocation to be done in each scheme.

There are four asset classes from which the allocation is to be specified under a single PFM

- Asset Class E – Equity and related instruments

- Asset Class C – Corporate debt and related instruments

- Asset Class G – Government Bonds and related instruments

- Asset Class A - Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc

While choosing the asset class, subscribers must note that

- Percentage contribution value cannot exceed 5% for Alternative Investment Funds

- The total allocation across E, C, G and A asset classes must be equal to 100%.

- For Tier-II, you can allocate 100% to Equity.

- For Tier-I, you can allocate 75% to Equity.

Investment Choices

Active Choice

Under Active Choice, you can plan and choose on how your contribution is to be invested. You can choose the PFM, the scheme(s) as well as the percentage allocation in the asset classes.

| Asset Class | Maximum allocation of investment in the asset class |

| E | Up to 75% |

| C | Up to 100% |

| G | Up to 100% |

| A | Up to 5% . Note: Investment in Asset Class A is available only for NPS Tier 1 account. |

Auto Choice

NPS offers an easy option for you to invest in a Life-cycle fund in which the proportion of funds invested across three asset classes that are determined by a pre-defined portfolio and would change as per your age.

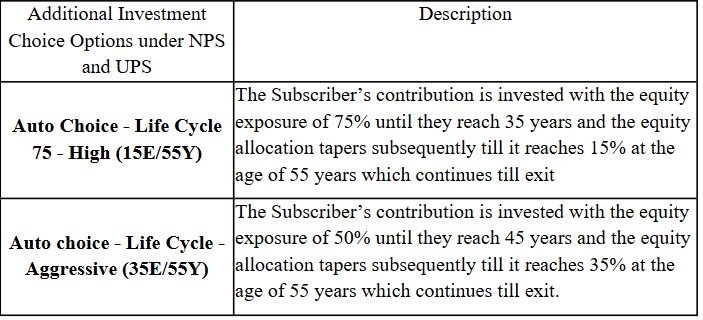

As age increases, your exposure to Equity and Corporate Debt tends to decrease under Auto Choice. Depending upon your risk appetite, there are four different options available within ‘Auto Choice’ – Aggressive, Low, Moderate and High.

- Life Cycle 75 – High (15E / 55 Y)

- Life Cycle 50 – Moderate (10E / 55 Y)

- Life Cycle 25 – Low (5E / 55 Y)

- Life Cycle – Aggressive (35E / 55 Y)

Investment choices currently available for Central Government employees

Pension

Calculator

This pension calculator illustrates the tentative Pension and Lump Sum amount you may expect on maturity based on regular monthly contributions, percentage of corpus reinvested for purchasing annuity and assumed rates in respect of returns on investment and annuity selected for.

Know More

Check

Eligibility

You should be between 18 - 70 years of age as on the date of submission of your application to the POP/ POP-SP / online through e-NPS

Know MoreCharges

Under NPS

NPS is a low cost product as compared to similar pension products across the globe.

While saving for a long-term goal such as retirement, the cost matters a lot as the charges can trim off a significant amount from the corpus over 35-40 years of investment period

Know More

Important FAQs

The four asset classes are

- Asset Class E – Equity and related instruments

- Asset Class C – Corporate debt and related instruments

- Asset Class G – Government Bonds and related instruments

- Asset Class A - Alternative Investment Funds including instruments like CMBS, MBS, REITS, AIFs, Invlts etc